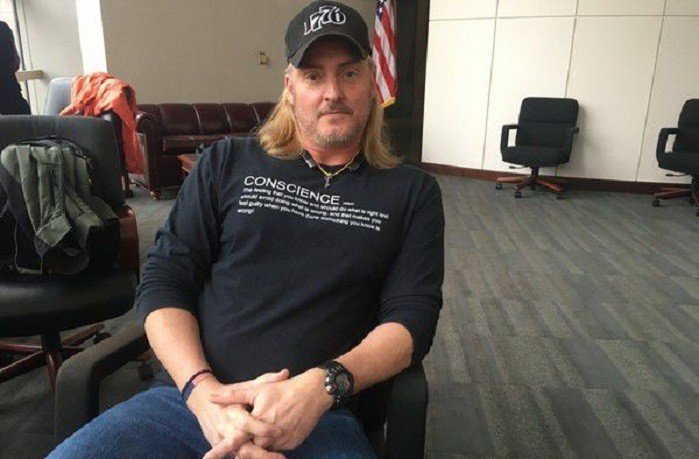

An Oregon man is back in court this week after he refused to pay taxes because they fund the killing of unborn babies.

A lawyer for Michael E. Bowman, of Columbia City, said his client has deeply-held convictions against abortion, in part, because his own unborn child was aborted many years ago, The Oregonian reports. Matthew Schindler told a federal jury that when Bowman was a teenager, his pregnant girlfriend’s parents forced her to have an abortion, and he could do nothing to stop it.

Bowman, a pro-life Christian, has refused to pay income taxes or file tax returns for more than two decades, National Review reported earlier this year. He repeatedly has made it very clear why: He believes unborn babies are valuable human beings, and killing them is wrong.

Bowman lives in Oregon, one of 16 states that forces its taxpayers to pay for elective abortions through its medical assistance program. Nationwide, taxpayers also give about half a billion dollars to Planned Parenthood, the largest abortion chain in the U.S.

In 2018, Bowman won a victory in court when a federal judge dismissed one of the charges against him: felony tax evasion, the Miami Herald reported at the time.

However, he still faces four misdemeanor tax charges, according to The Oregonian. His jury trial in the case began Monday in Portland.

Click Like if you are pro-life to like the LifeNews Facebook page!

Here’s more from the report:

Special Assistant U.S. Attorney Rachel Sowray argued that the 54-year-old man who worked independently as a computer contractor acted deliberately “because he disagrees with the law.’’

“Disagreement with the law is different than misunderstanding the law and disagreeing with the law is not a valid defense,’’ Sowray told jurors in her opening statement. …

Matthew Schindler, Bowman’s defense lawyer, said his client never acted with criminal intent, but instead was driven by his deeply rooted Christian conviction that human life is sacred and his desire not to give money to the government to fund abortion.

Bowman isn’t “some kind of mumbo jumbo tax protester’’ who doesn’t believe wages aren’t income, Schindler said. Instead, it was Bowman’s “good faith’’ belief that the IRS had to make an accommodation for his views under the Religious Freedom Restoration Act, the First Amendment and the Oregon Constitution.

He also noted that the IRS did not contact Bowman, even though he did not file a tax return for 18 years.

“It never collected a single dime from him during those 18 years. That inaction, that failure, convinced him that he was right,” Schindler said.

Bowman is a self-employed computer software developer and owes at least $800,000 in back taxes, according to the Herald. If convicted, he could face an additional $25,000 in fines.

Many Americans, like Bowman, oppose their tax dollars being used to pay for abortions. A recent national poll by Marist University found that a majority of Americans oppose taxpayer funding of abortions, while just 39 percent support them. Similarly, a 2016 Politico/Harvard University poll found that 36 percent of likely voters supported taxpayer funding for abortions, while 58 percent opposed it.

Please click here to read the full story.

Author: Micaiah Bilger